-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Khalid Mustafa*

Corresponding Author: Khalid Mustafa, Professor, Department of Economics, Jinnah University for Women, Private university in Karachi, Pakistan.

Received: April 19, 2024 ; Revised: May 13, 2024 ; Accepted: May 16, 2024 ; Available Online: June 05, 2024

Citation:

Copyrights:

Views & Citations

Likes & Shares

This research aims to investigate the weak-form efficiency test within Pakistan's real estate market, exploring whether market prices follow a random walk or not. In order to determine whether Pakistan's real estate market prices are random or not, three techniques, i.e., the autocorrelation test, the run test, and the variance ratio test, are applied. The autocorrelation captures the randomness of returns on the market in Pakistan; the run test explains the concept of return independence; and the variance ratio examines the predictability of returns. The data used in this study covered on a monthly basis from January 2011 to June 2023. The results show the absence of a random walk model in Pakistan's real estate market as well as regional markets, i.e., Karachi real estate market, Lahore real estate market, and Islamabad real estate market. It employs Pakistan's real estate market in its weak form, which is not efficient. It shows that investors could make substantial real estate returns as they have past price information that could be used to forecast future prices.

Keywords: Real estate market, Autocorrelation test, Run test, Variance Ratio test

JEL Classification: I15, I18, I38

INTRODUCTION

The random walk hypothesis suggests that changes in asset prices are random and past price changes are unimportant for future price changes. It demonstrates the weak form of an efficient market hypothesis. The behavior of prices, however, also depends on the nature of the market.

A first-time random walk model has been applied to asset prices, showing evidence to support the weak efficient market hypothesis. The test of the efficient market hypothesis with real estate data began in the mid-80s. The predictive methodology has been applied as an empirical test for numerous developed and underdeveloped markets in real estate market research. Because there was doubt about the validity of an efficient market hypothesis on the real estate market, a growing number of empirical studies, such as Gau's [1], found the reason for testing the market efficiency of this real estate market. Case and Shiller [2] also saw the need to test market efficiency by using real estate data as evidence.

In comparison to other financial markets, the real estate market features high transaction costs, asymmetrical data, and low turnover. It leads to securing evidence of real estate market inefficiencies. A poorly functioning real estate market causes several illnesses: the creation of slums and squatter settlements, the deterioration of the environment, and an inefficient urban development pattern that increases urban business costs and adversely affects the urban economy.

The real estate sector in Pakistan has grown substantially with economic liberalization. As a result, Pakistan's demand for property has increased with business opportunities and labour immigration. It is said that "real estate is traded as a commodity in Pakistan"; speculative investors buy property in bulk and then sell it for an absurdly high profit in the short term.

The reason for investing in short-term gains was that the real estate market was not regulated or taxed until 2014. The government maintained a policy of "no questions asked "about the source of the capital coming in, and the sector remained the ideal place to park black money for decades. As a result, the lower and middle-income groups were unable to afford any residents. It has led to the creation of a property bubble with artificial price increases and increased demand and supply.

In 2014, the government of Pakistan amended the 2001 revenue tax order, which is related to the property's valuation. Demand on the real estate market is continuously declining, and people speculate without any intentions on the real estate market. Besides, investors holding black money are unwilling to invest in the real estate sector, leading to a fall in property prices. They are reluctant to engage in any activity that allows a federal board of revenue (FBR) to check its bank accounts and thus increase the deficits of confidence of the government and citizens. It thus helps to reduce the real estate market rapidly.

The State Bank of Pakistan (SBP) has initiated the valuation of land and property under the Inland Revenue Department of the FBR. This initiative has been taken to protect the investors' interests. Besides, with the purpose of strengthening the mechanism of market-based housing finance, SBP has established the Department of Infrastructure and Housing Finance.

The Inland Revenue Department has introduced a time frame for the capital gains tax (CGT) on property. On the other hand, CGT was levied on property in the past within one and two years at a rate of 10 and 5 percent, respectively. As a result, the top housing market, a considerable fall in prices is evident. The demand for apartments has risen by almost 30 percent, resulting in an increasing number of newly built high-rise luxury apartments in Lahore and Islamabad.

A few leading causes of slow growth in the real estate market are transaction costs, a lack of timely information, the cost of acquiring market updates, and, in particular, uncertainty about the future. Also, there is insufficient data in a convenient form, a structural profile, inadequate regulations, a lack of supervision, and administrative looseness in the implication of existing rules in Pakistan's real estate market. Over a while, the market moved to become a market for speculation and then a market for gambling. It shows that market movement follows the trend, and investors in the market are becoming speculators at large.

The relevance of information arrival is significant for market efficiency. The efficient market hypothesis suggests that all information on a property is priced and cannot, therefore, be exceeded by selecting the best properties. Not all relevant information is often available in real estate. Prices do not reflect all relevant information. Besides, a piece of property may have multiple "correct" prices, depending on what the buyer intends to do with it. It is part of the highest and best use concept, which is also not always observed. Moreover, sellers are not always priced alone. The question of efficiency of real estate is vital for this market because of the nature of this market and the claim that the market is as efficient as the stock market.

RESEARCH GAP

A research gap exists due to the absence of thorough studies evaluating the performance of the Pakistani real estate market, especially concerning the random walk hypothesis and the weak form of the efficient market hypothesis. While empirical studies exist for various markets, both developed and underdeveloped, there's a notable scarcity of research dedicated to Pakistan's real estate market. This disparity highlights the necessity for further exploration into whether property prices in Pakistan adhere to random patterns and if the market operates efficiently in its weak form. Additionally, there's a dearth of empirical data regarding the influence of regulatory changes, such as tax policies, on the performance and behavior of the real estate market in Pakistan. Consequently, this study presents an opportunity to address these gaps and enrich the existing literature by providing insightful perspectives into the dynamics of Pakistan's real estate market.

The focus of this study is first to apply the concept of an efficient market hypothesis to Pakistan's real estate market as developed in the financial market. Finally, to carry out an empirical investigation into the weak form of an efficient market hypothesis using Pakistan's real estate market as evidence. To better explain the purpose of this study, the research questions are:

Research Question:

Research objectives:

The rest of the paper has the following organization: A review of the literature is given in section two; section three explains the research methodology; an analysis of weak-form efficient market hypotheses is given in section four; and conclusions, suggestions, and recommendations are given in section five.

REVIEW OF LITERATURE

Numerous studies have investigated the weak form efficiency of real estate markets, with approximately two-thirds of these studies providing evidence of inefficiency within the market. Early studies by Gau [1] and Hamilton and Schwab [4] examined residential markets in Canada and the US, respectively, yielding conflicting findings. Gau [1] asserted the efficiency of the residential market in Canada (Vancouver) but found inefficiency in the US, as indicated by Hamilton and Schwab [4].

Skantz and Strickland [5] demonstrated the significant impact of floods on residential prices, with prices declining gradually over time despite immediate flood events. This decline was attributed to increased flood insurance rates, suggesting the sensitivity of public information within the real estate market.

Case and Shiller [2] analysis of residential price indices in Atlanta, Dallas, Chicago, and San Francisco revealed high serial correlation in house pricing, indicating inefficiencies in market response to available information.

Guntermann and Norrbin [6] reported inefficiencies in the real estate market when applying weak form efficiency tests, particularly in commercial properties and certain attributes of real estate requiring specialized knowledge.

Darrat and Glascock [7] established the efficiency of the property market, highlighting the role of economic variables in influencing real estate prices.

Meese and Wallace [8] examined the impact of factors such as rent and capital costs on residential housing efficiency, finding short-term price movements to be unpredictable while acknowledging the potential for market distortions.

Wang [9] argued against the heterogeneity of housing units as a direct cause of market inefficiency, while Rosenthal [10] struggled to forecast nominal house price inflation in the UK, suggesting weak performance in the real estate sector.

Larsen and Weum [11] utilized rate indices derived from repeated sales of identical units to assess first-order autocorrelation within the single-family housing market. Their research evaluated the predictive capacity of capital gains, dividends, and interest expenses based on return data. These studies scrutinized the efficiency of residential markets in the US, Canada (Toronto), and Norway (Oslo), ultimately rejecting the market efficiency hypothesis.

In addition to the conventional variance-ratio test, French [12] employed the Wright [13] methodology to scrutinize the behavior of the UK real estate market and construction safety indices. Their findings suggested a significant reliance on index return series and decisively rejected the random walk hypothesis for UK real estate indices, highlighting a lack of confirmation for the efficient market hypothesis (EMH) within the UK market.

Schindler [14] investigated the efficient market hypothesis across 12 emerging real estate markets and four established markets for the period 1992-2009, utilizing monthly data. Their study employed parametric tests focusing on autocorrelation and variance ratios, alongside non-parametric tests via RWM for business performance. Despite testing for weak form efficiency using the random walk model, the study did not conclusively reject the hypothesis for emerging markets, contrasting with previous findings in Asia Pacific, Argentina, and South Africa.

Yajie [15] employed statistical techniques to analyze the performance of the Chinese residential real estate market. His findings suggested that housing prices do not promptly adjust to new information, leading to the conclusion that the market does not adhere to weak form efficiency, as determined by self-correlation and unit root tests based on the Augmented Dickey-Fuller test.

AlMudhaf and Andrew [16] conducted variance ratio tests, revealing that accommodations, resorts, and self-storage sectors do not exhibit a random walk pattern, thus challenging the weak form efficiency of the market hypothesis. Their results indicate varying levels of informational efficiency among different subsectors within the real estate market.

Bayer [17] demonstrate a direct causal link between investment activity proximity and the likelihood of individuals entering the housing market as investors. The impact of such spillovers is significant: having an investor within one tenth of a mile increases the likelihood of household engagement in housing investment by 8 percent within a year, rising to 14 percent over three years.

Szumilo [18] focuses on exploring the informational repercussions for neighbors when a homeowner opts to renovate their property. The research methodology distinguishes between interior renovations, which affect individual house prices but not neighborhood desirability overall. Through this approach, the author uncovers notable price spillovers: a mere 1 percent increase in the price of a house undergoing interior renovations can lead to up to a 0.3 percent increase in neighboring home prices.

Dumm [19] delve into the repercussions of local household sinkhole claims on house prices in Florida. Sinkhole claims, which often result in denial, cash settlement, or remediation, particularly interest the authors due to the latter's lesser association with fraudulent activities, a prevalent concern in the state. As expected, the public revelation of a sinkhole claim adversely impacts the prices of the affected and neighboring properties. Buyers, in accordance with efficient market theory, differentiate between properties with remediated sinkholes and those without, as well as between settled and denied claims. Even if a claim is rejected by insurers, its impact lingers, albeit to a lesser extent. This unearthing of a negative externality stemming from potential fraudulent claims adds significant insights to existing literature.

Broxterman and Zhou [20] undertake a thorough review of research concerning the economics of information in the real estate sector, spanning equity investment in private and public markets, and the intermediary role of brokers. Their findings illustrate that analyzing the nature and extent of information asymmetries in these critical markets has enriched the understanding of potential market failures and facilitated the implementation of corrective measures to enhance market efficiency.

Broxterman [21] delve into the dynamics of price reactions to new information. Their investigation centers on the speed, accuracy, and persistence of these reactions, acknowledging that a market's allocative efficiency depends on its informational and operational efficiency. Their findings unveil that despite the private nature of real estate transactions, house prices swiftly respond to new information regarding factors such as indirect catastrophic events, environmental risks, and market disruptions. However, these reactions tend to diminish over time, indicating a tendency among market participants to prioritize recent information over historical data. Additionally, strategic information usage is observed in markets characterized by costly search processes and asymmetric information distribution.

The hypothesis investigates the general efficiency of real estate markets with a particular focus on the weak form of market efficiency, and it asks if real estate markets follow the weak form of market efficiency. It includes conclusions from numerous studies looking into how effective real estate markets are in various locations and situations. According to the other theory, real estate markets could show signs of inefficiency, such as a price correlation that repeats itself or a slow reaction time to fresh information. This conjecture functions as a fundamental examination of the effectiveness of real estate markets, providing a framework for subsequent studies into particular elements impacting market efficiency.

The research aims indicated in the literature review are guided by these hypotheses, which seek to evaluate the real estate markets' poor form efficiency by utilizing empirical information from prior studies. Researchers can learn more about the dynamics of price movements and information transmission within real estate markets by examining the results of these studies and drawing judgments about how closely real estate markets adhere to the principles of market efficiency.

METHODOLOGY

A statistical methodology is applied as prescribed by Niemczak and Smith [22] to examine a random walk of Pakistan's real estate prices. This study investigates the randomness of a time series analysis; both parametric and non-parametric methods are used. The study uses data from the time series and assumes that the data is stationary. If the data is not stationary, the first difference (time-to-time periods) will be calculated to make it stationary. All this process was created under a unit root test. The first step of the random walk model after this preliminary examination is to investigate the autocorrelation coefficient test, followed by a run test, and the final stage is the variance ratio test. The autocorrelation captures the randomness of returns on the market in Pakistan; the run test explains the concept of return independence; and the variance ratio examines the return predictability.

The autocorrelation function is used in a given time series to measure the dependence of successive terms. This tool is used to test the weak form of an efficient market hypothesis. The autocorrelation function formula is given below:

The standard error and t values of the autocorrelation function are:

If the first lag of the autocorrelation function is less than twice the standard error of the series, then the series follow a random walk.

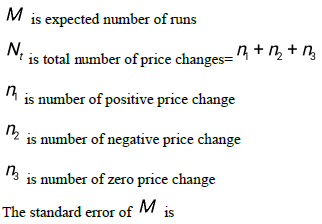

The run test is used to investigate the independence of returns. This test analyzes runs in a series of data sets by comparing the expected number of runs with the number of runs observed. The expected number of runs can be calculated as given by Wallis and Roberts [23].

Where

For large samples, the distribution of a total number of runs of each type is normal with a mean and variance. A process is said to be random if the actual number of runs falls above the range, it indicates that the series does not follow the random walk, and if it falls within the given range, the series will follow a random walk.

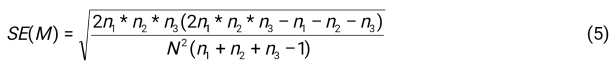

Another technique for investigating the predictability of the real estate market is the variance ratio test, developed by Lo and Mackinlay [3]. This test is derived regarding increments of variance from the assumption of the linear relationship of observations' interval.

The variance of the Kth difference variable is as significant as that of the first difference if a series follows the random walk process. For time series characterized by random walk, one kth of the

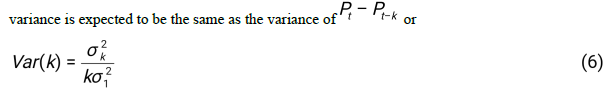

which indicates the asymptotic nature of distributional equivalence, while various studies have argued that, in terms of time variance, returns are conditionally heteroscedastic. Theodossiou and Lee [24], Koutmos, Theodossiou and Lee [25] and Theodossiou, Koutmos and Negakis [26]. As a result, there may be no existence of a linear relationship over observation intervals. Lo and Mackinlay [3] derived the heteroscedasticity consistent variance estimators from overcoming this problem.

The dataset utilized in this research spans from January 2011 to June 2023, encompassing monthly observations. It comprises real estate prices from Pakistan and its regional markets, including Karachi, Lahore, and Islamabad. The data for these variables were sourced from Zameen.com, and the observations are aggregated on a monthly basis throughout the specified timeframe.

DISCUSSION

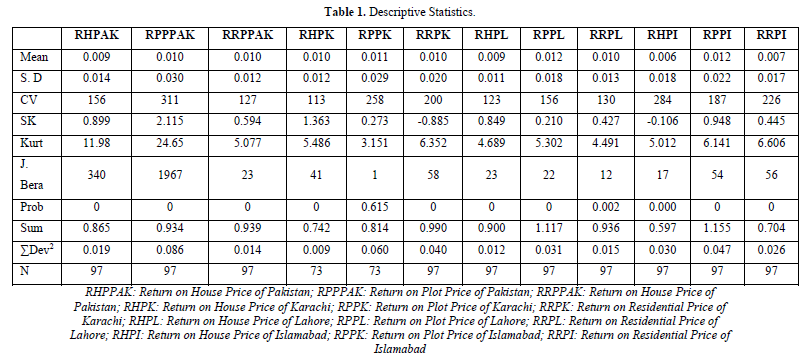

Descriptive Statistics

The descriptive statistics presented in Table 1 provide valuable insights into the distributional characteristics of monthly real estate return data from Pakistan and its regional markets, namely Karachi, Lahore, and Islamabad. These include return on house price in Pakistan (RHPPAK), return on residential price in Pakistan (RRPPAK), return on plot price in Pakistan (RPPPAK), return on house price in Karachi (RHPK), return on residential price in Karachi (RRPK), return on plot price in Karachi (RPPK), return on house price in Lahore (RHPL), return on residential plot price in Lahore (RRPL), return on plot price in Lahore (RPPL), return on house price in Islamabad (RHPI), return on residential price in Islamabad (RRPI), and return on plot price in Islamabad (RPPI). These statistics offer a foundation for understanding the behavior and dynamics of real estate prices, shedding light on potential patterns and deviations from normal distributions.

Analysis reveals that the distributions of RHPPAK, RRPPAK, RPPPAK, RHPK, RRPK, RPPK, RHPL, RRPL, RPPL, RHPI, RRPI, and RPPI frequencies are non-uniform. In Gaussian distributions, a skewness coefficient of 0 indicates symmetry around the mean. Negative skewness suggests that most values cluster to the right of the mean, with extreme values to the left, while positive skewness indicates the opposite. Blume [27] proposed a rule of thumb: skewness coefficient less than -1 or greater than +1 signifies highly skewed distribution, between -1 and -1/2 or between +1/2 and +1 indicates moderate skewness, and between -1/2 and +1/2 indicates approximate symmetry. RPPK, RPPL, RRPL, RHPI, and RRPI exhibit approximately symmetric skewness, with skewness coefficients falling between -1/2 and +1/2. RHHPAK, RRPPAK, RRPK, RHPL, and RPPI display moderate skewness, with coefficients between +1/2 and +1 or -1/2 and -1. RRPPAK and RHPK demonstrate high skewness, with coefficients below -1 or above +1.

Skewness coefficients highlight the asymmetry of the return distributions, with some series displaying moderate to high skewness. This indicates that the distribution of returns is not symmetrical around the mean, with some exhibiting clustering towards one tail of the distribution. Moreover, kurtosis coefficients exceeding 3 suggest Leptokurtic distributions, indicating sharp peaks and fat tails in the return distributions.

The Jarque Bera (JB) test further confirms non-normal distribution patterns, particularly in the returns of Pakistan's real estate markets, except for Karachi. This underscores the presence of significant skewness and kurtosis, deviating from the assumption of a normal distribution.

The coefficient of variance reveals varying levels of unpredictability and consistency across different return series, with some exhibiting higher levels of uncertainty compared to others. For instance, RRPPAK displays the highest coefficient of variance, indicating instability, while RHPK demonstrates a lower variance, suggesting more consistent returns.

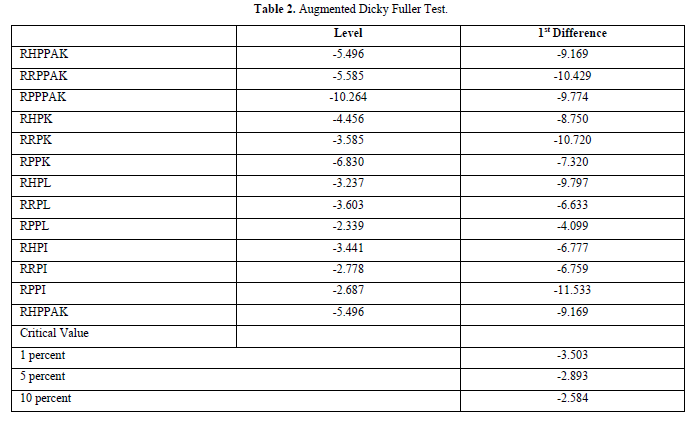

Augmented Dickey-Fuller Test

The results presented in Table 2 depict the outcomes of the Augmented Dickey-Fuller (ADF) test, indicating mixed evidence regarding the presence of a random walk in Pakistan's real estate returns. While the null hypothesis cannot be dismissed upon first differencing, there are indications of some level of predictability, as evidenced by higher return values at the first lag compared to critical values during certain periods. However, it's essential to note that the presence of a random walk model does not imply complete unpredictability in real estate returns.

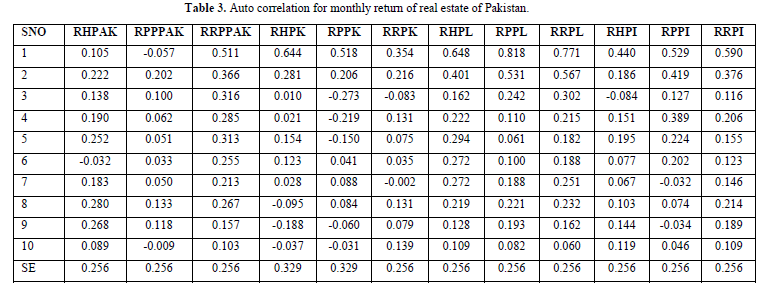

Autocorrelation Test

Table 3 provides the autocorrelation of monthly real estate prices. The autocorrelation test provides further insights into the persistence of real estate price movements, with positive autocorrelation observed at lag 1, the autocorrelation is positive and exceeds twice the standard error, specifically at 0.256 for RPPPAK, RHPK, RRPK, RPPK, RHPL, RRPL, RPPL, RHPI, RRPI, and RPPI. This suggests deviations from a random walk pattern, particularly in plot prices in Pakistan and specific city returns.

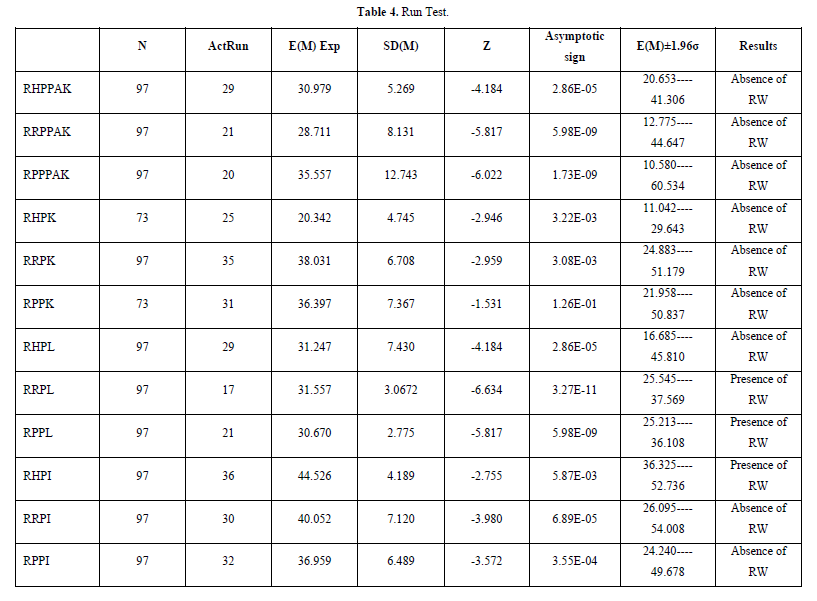

Run Test

The run test serves as another method to assess and identify sequence randomness, specifically in determining whether a sequence adheres to a random walk pattern. This test evaluates the runs within a dataset by comparing the expected and actual number of runs. By translating the cumulative runs into a z metric, the run test provides insights, particularly for large sample sizes, regarding the likelihood of deviation between observed and predicted runs. A z value equal to or greater than ±1.96 rejects the null hypothesis at a 5% significance level [28].

Table 4 presents the results of the Run test. The results indicate that the z statistics for monthly returns, both for overall real estate prices in Pakistan and for specific cities, exceed ±1.96 and are negative. However, the observed number of runs falls short of the expected count, with a statistically significant level observed across Pakistan's real estate market. Moreover, if |Z| > 1.96 at the 5% significance level, it suggests that the series lacks randomness. This criterion applies to all return series of Pakistan's real estate prices except for RPPK, indicating a departure from the random walk hypothesis in Pakistan's real estate market.

Variance Ratio Test

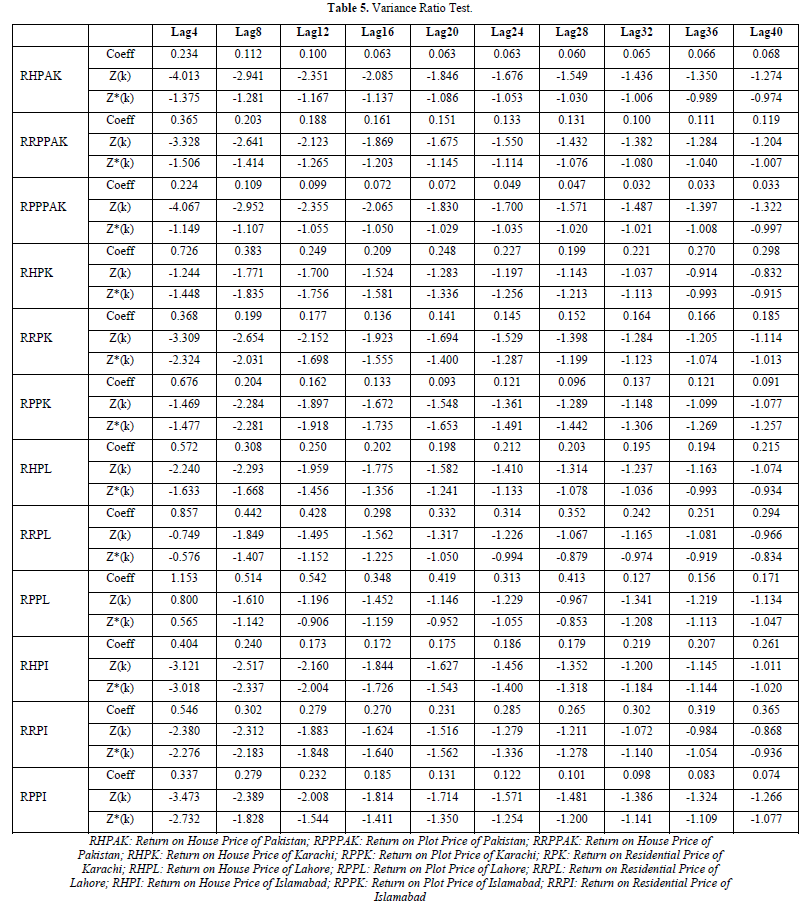

When short-term fluctuations dominate the stochastic elements, the ADF test outcomes for real estate sets become inconclusive. To address this, the variance ratio test incorporates both homoscedastic (Z(k)) and heteroscedastic (Z*) terms into real estate returns (k). Table 5 consistently demonstrates this across all periods.

The null hypothesis of the random walk suggests that the variance ratio equals one. Deviation from this value implies a mean reversion in real estate prices. The variance ratio test diminishes with increasing lags in all the chosen real estate return series for Pakistan. With the exception of RPPL, whose variance exceeds one, all series exhibit a variance ratio below unity, indicating a negative auto-correlation in monthly real estate returns. Only RPPL, representing returns on plot prices in Lahore, exhibits a positive serial correlation with monthly real estate returns.

However, homoscedasticity Z(k) exceeds 1.96 in RHPPAK, RRPPAK, RPPPAK, RRPK, RHPL, RHPI, RRPI, and RPPI, suggesting no evidence of a random walk pattern with increasing lag values. At a 5% significance level, the heteroscedasticity test statistic Z(k) rejects the random walk hypothesis for all real estate return series in Pakistan. This implies that future real estate price movements can be forecasted using past price movements. The presence of autocorrelation in the financial market does not necessarily indicate inefficiency.

In conclusion, Z(k) rejects the null hypothesis: (a) for RHPPPAK, RPPPAK, and RRPK with 4 to 16 holding lags; (b) for RRPPAK, RHPL, RHPI, and RPPI with 4 to 12 holding lags; (c) for RPPK and RRPI with 4 to 8 holding lags; and (d) for RHPK, RRPL, and RPPL with no lags at 5%. Additionally, the variance ratio test indicates values below one for all real estate return series, suggesting a negative serial correlation. This implies that infrequent real estate trading significantly contributes to negative serial correlation while mean reversion increases.

The above results contribute to the ongoing discussion on the efficiency of Pakistan's real estate market, highlighting the presence of significant deviations from random walk behavior and providing empirical evidence of non-normal distribution patterns and serial correlation in returns. Comparing these findings with those from previous studies in the extant scientific literature can offer valuable insights into the broader context of real estate market efficiency and dynamics.

CONCLUSION

Several important conclusions are drawn from the analysis of weak-form efficiency in the monthly data from January 2011 to June 2023 of Pakistan's real estate market and its regional markets (Karachi, Lahore, and Islamabad), which was done using autocorrelation, run, and variance ratio tests.

Firstly, the autocorrelation test rejects the random walk hypothesis for monthly returns, indicating a lack of independence among consecutive return observations. This suggests that real estate prices in Pakistan do not follow a random walk pattern and are influenced by past price movements.

Secondly, the run test further supports this conclusion by indicating the non-independence of returns, reinforcing the presence of interdependence among return observations.

Lastly, the variance ratio test provides additional evidence by rejecting the presence of a random walk, thereby suggesting a lack of weak-form market efficiency in Pakistan's real estate market. This implies that past price movements can be used to forecast future price changes, contradicting the efficient market hypothesis.

These findings have significant managerial implications for investors and stakeholders in Pakistan's real estate market. The rejection of weak-form efficiency suggests that investors may be able to exploit predictable patterns in real estate prices to make informed investment decisions. However, it also implies that market inefficiencies may exist, leading to potential risks and uncertainties for investors.

Despite the valuable insights provided by this research, several limitations should be acknowledged. Firstly, the analysis is based on historical data up to June 2023, and market conditions may have evolved since then. Additionally, the study focuses solely on weak-form efficiency and does not consider other forms of market efficiency or factors that may influence real estate prices, such as economic conditions or government policies.

For future research directions, it may be beneficial to explore other forms of market efficiency, such as semi-strong and strong-form efficiency, and investigate the impact of external factors on real estate prices. Furthermore, extending the analysis to include a broader range of real estate markets in Pakistan and considering longer time periods could provide a more comprehensive understanding of market dynamics and efficiency levels.

The empirical findings of this study challenge the notion of weak-form efficiency in Pakistan's real estate market, indicating the presence of predictable patterns in real estate prices. These results have important implications for investors and highlight the need for further research to deepen our understanding of market efficiency and dynamics in Pakistan's real estate sector.

No Files Found

Share Your Publication :